SQL Events

All events curated from our conference, talking gigs, seminars, training and more

🚨 What's? LHDN E-Invoice is More Than Just Billing!

Bosses, and Accountants, did you know that even dividends are required to be e-invoiced?

In this seminar, you will not just be learning about the laws and regulations regarding E-Invoice. Our panel of experts will also share insider guides about LHDN E-Invoices, navigating dangers, exploiting opportunities. Are accountants and bookkeepers facing risks or riches?

- Pre-E-Invoice vs. E-Invoice: What’s changed and what needs your attention?

- Do’s and Don’ts: Navigate the transition smoothly and avoid pitfalls.

- Peppol vs. LHDN E-Invoice: Demystify the difference and understand compliance requirements.

- E-Invoicing Optional for Customers: What’s the Deal?

- Foreign Workers Without Permits: Self-Bill E-Invoicing Required?

If you have any concerns about the risk factors in your business industry, by the end of this session, everyone will have the opportunity to ask questions, and our experts will provide answers to address your queries.

🆓 Limited seats, first come first serve

Fee: RM 99 → Free, sponsored by SQL Account, others software users are welcome to join

*An e-Certificate of Attendance is provided

SQL Business Budget 2021

The Budget 2021 is expected to be unveiled on 6 November 2020 with focus on 4 themes:

1. Caring for the People

2. Steering the Economy

3. Sustainable Living

4. Enhancing Public Service Delivery

It is expected to set the SME and rakyat on the right track to post-pandemic economic recovery.

2020 is a love and hate year as businesses faced the biggest challenge in their lives, writing off few years’ profit in a single month. Conversely, it is the first time

businesses successfully claimed a subsidy or grant from government.

Budget 2021 is expected to complement by the recovery packages rolled out, which includes Wage Subsidy Programme and Penjana packages. Question is : is there more to grab?

It is also expected to see heavy emphasis on deployment of technological and digital adoption by SMEs, and nurture digital innovation by young entrepreneurs. Back by tax rebates and digitalisation grants from MDEC, it seems like it will be an interesting year to come.

Let us discover more and how you can position yourself to take advantage of these initiatives.

Not only that, the webinar is also a yearly refresher course to update you on all the changes in taxes.

Join us at this yearly SQL Business Budget Seminar sponsored by SQL Accounting Software. As a software house, we care about your Business Affairs.

See You there !

Workshops

Over 5000 users of SQL participated in the discussion, with the implementation of operational and preventive customizations, our users have increased the efficiency of their companies by more than 30%. Share with us your unique business process. Our team will assist you with implementing your business logic into SQL Software in order to streamline your business process and increase efficiency!

SQL Business Budget Webinar 2024:

This webinar will cover all the essential updates, including the new E-Invoice Implementation, SST increase, and other tax changes. You will also learn effective strategies to align your business model with the government’s vision and minimize the impact of these changes on your operations.

Language: English Online Webinar with 中文讲解

Register now for our early bird discount, subsidized by SQL. Limited to the first 1000 registrants!

Budget 2023 Webinar - Reinforcing your business with Tax updates

Attention Entrepreneurs! Are you aware of the new Tax system implemented by the government? Learn how the latest changes will affect your business operations!

Join our Business Budget Webinar and bring along your Accounting Team to understand the new tax system and avoid potential Penalties & risks of fines.

Register now, first 1000 to enjoy a subsidy of SQL! For only RM29, you can learn the latest tax in this webinar!

Budget 2021 - Business 'Now' & 'Next'

The Budget 2021 is expected to be unveiled on 6 November 2020 with focus on 4 themes:

1. Caring for the People

2. Steering the Economy

3. Sustainable Living

4. Enhancing Public Service Delivery

It is expected to set the SME and rakyat on the right track to post-pandemic economic recovery.

2020 is a love and hate year as businesses faced the biggest challenge in their lives, writing off few years’ profit in a single month. Conversely, it is the first time

businesses successfully claimed a subsidy or grant from government.

Budget 2021 is expected to complement by the recovery packages rolled out, which includes Wage Subsidy Programme and Penjana packages. Question is : Is there more to grab?

It is also expected to see heavy emphasis on deployment of technological and digital adoption by SMEs, and nurture digital innovation by young entrepreneurs. Back by tax rebates and digitalisation grants from MDEC, it seems like it will be an interesting year to come.

Let us discover more and how you can position yourself to take advantage of these initiatives.

Not only that, the webinar is also a yearly refresher course to update you on all the changes in taxes.

Join us at this yearly SQL Business Budget Seminar sponsored by SQL Accounting Software. As a software house, we care about your Business Affairs.

See You there !

Employer Tax Obligation

This is a MUST ATTEND updates on employer & employee tax obligation webinar.

Employer : Risk & penalties areas for Form E (Borang E), Benefit in Kinds (BIK) , Director Fees, Tax exemption allowances. understand the type of employment income

Employee : Understand on e-filling submission, personal tax relief (for tax saving) , employment income & benefit planning.

Each session webinar with limited attendees, sign up now

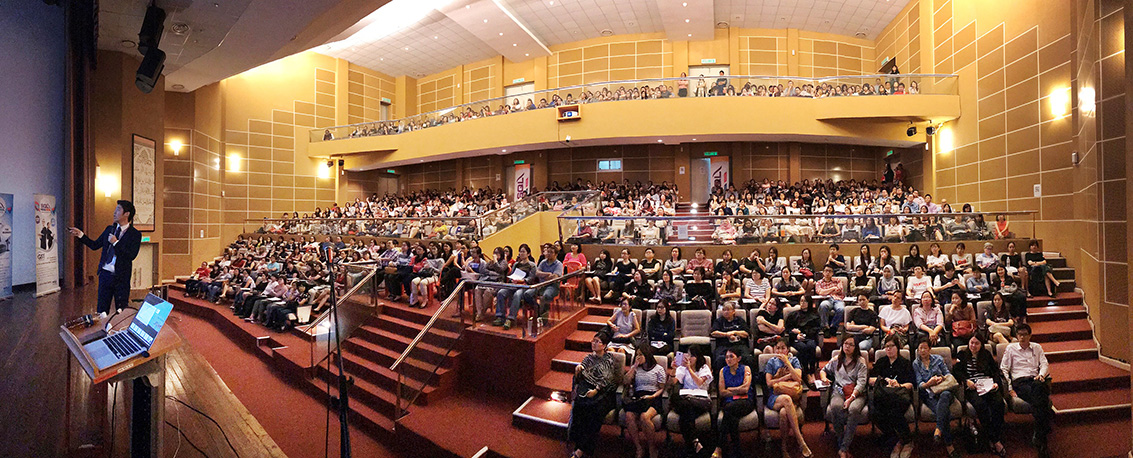

Nationwide Budget 2020 Tax & Business Conference

This is a Must Attend annual seminar to keep yourself equipped with insightful tax updates and business knowledge.

Budget 2020 have a strong focus on supporting Malaysian SME. Government initiated different software grants and funding opportunities with easy approval process. Seize the opportunities to learn how to get the grant. Various tax incentives & amendments will also be share in-depth.

This event is FREE and sponsored by SQL Account. All are welcome, no restriction.

Sales and Service Tax 2018 : Transitioning to SST + Implication of GST Repeal in 120 days

SST commence and GST expected to repeal on 1 September 2018. Businesses, What’s Next?

Visit the event registration form page for full course outline.

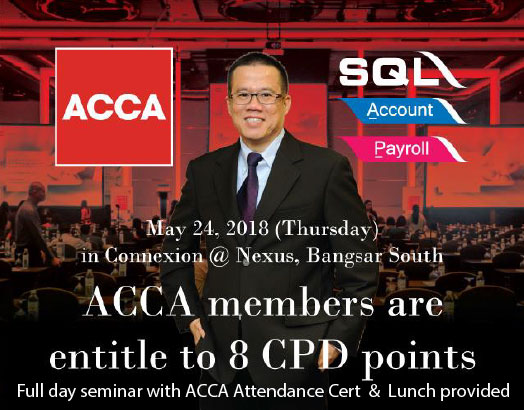

Income tax audit convergence with GST audit + GST to SST Transition by Dr Choong Kwai Fatt

Malaysia’s Foremost Tax Expert

Full day seminar with ACCA Attendance Cert, HRDF claimable & lunch provided. RM 371

This is the first of its kind seminar to help business professionals to gain an edge on understanding transitional issues from GST to SST. The seminar will also completely unlock on the methodologies and mechanism evolving income tax audit and GST audit that is still ongoing.

Practical approach as to dealing on SST transitional issues, income tax issues, GST issues would be unreservedly shared. The practical guide to appeal to Special Commissioners of Income Tax (SCIT) and GST Appeal Tribunal would be discussed extensively.

Is your company ready on Your Company Ready From GST 6% to 0% & From GST 0% to SST?

Spend 4 hours of quality time learning “GST 6% to 0% later to SST” updates from

Mr. Song Liew, GST and Tax Expert

This event is free and sponsored by SQL Account. Users using other software are welcomed to join.

This seminar will discuss all these topics which businesses should take note of for smooth transition.

GST is O% and its tax implications, Latest update and development, Pricing Strategy and Display Price, Tax invoice and Record Keeping, Transitional issues, Claiming input tax, New tax codes, SST model and methodology, Questions and Answers

Latest GST updates and Employer Tax with Dr. Choong Kwai Fatt Malaysia's Foremost Tax Expert

This events are organized and sponsored by SQL Account (E Stream Software Sdn Bhd)

Facebook Live with Dr. Choong Kwai Fatt

Facebook Live with Dr. Choong Kwai Fatt 28/09 (Thur) @ 5pmFacebook Live with DR. CHOONG KWAI FATT 28/09 (Thur) @5pm. We will discuss withholding tax & import services with Malaysia's foremost tax expert. Click "Get Reminder" to get notification before event starts. He will be here to answer your questions live in English or 中文. This online event is sponsored by SQL Account - Estream MSC.

Posted by SQL Account - EStream HQ on Thursday, 28 September 2017

FBLive_03Dr. Choong Kwai Fatt (钟贵发博士)将在10月11号(星期三)下午5点再次来到SQL Account进行面子书直播. 我们将在线上讨论预扣所得税(withholding tax) 以及进口服务消费税.点击PART 2“接收通知”以便直播开始前可以收到通知. 钟贵发博士会在直播里以英语和华文来解答大家的问题. 这场直播是由 SQL Account - Estream MSC 荣誉赞助. Dr. Choong Kwai Fatt will Facebook Live again on imported services and withholding tax PART 2 next Wed 11/10/17 @ 5pm. Click "Get Reminder" to get reminder notifications. Share with your friends and groups. This Facebook Live is sponsored by SQL Account - Estream MSC

Posted by SQL Account - EStream HQ on Wednesday, 11 October 2017