Capital Allowance

Capital Allowance is used as a subsidy to for the

depreciation of fixed assets. Capital allowance is given to reduce the tax payable for the

capital.

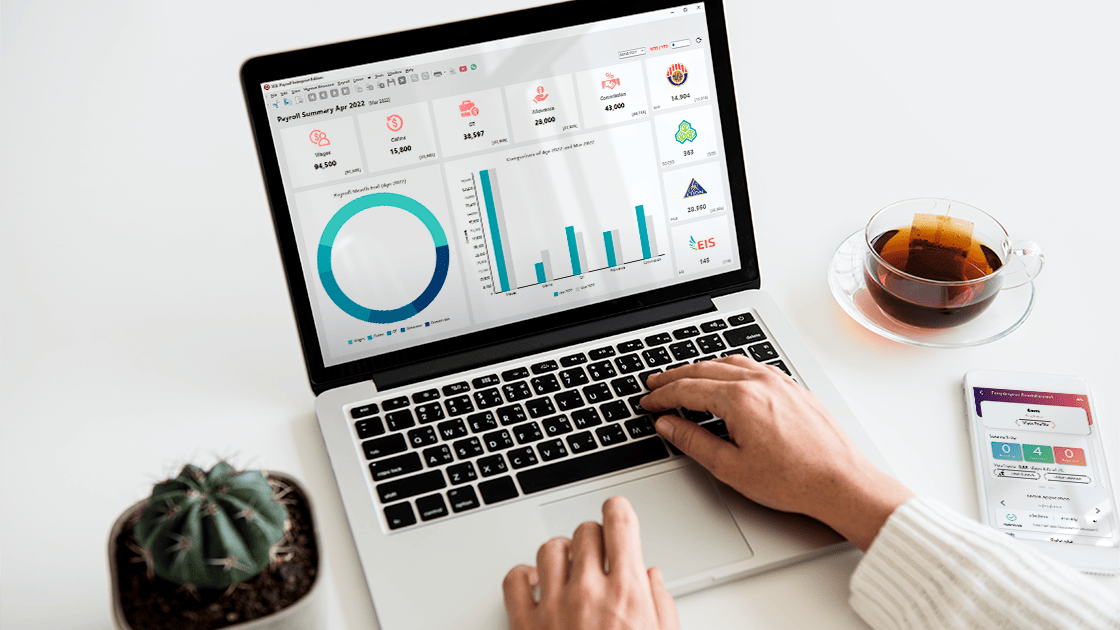

SQL Professional Fixed Asset Calculator Malaysia

for Capital Allowance 2024

| Year of Assessment | Qualifying Expenditure | Tax Written Down Value | Capital Allowance | Tax Written Down Value C/F | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| B/F | Additional | C/F | B/F | Additional | Total | I.A Rate (%) | I.A | A.A Rate (%) | A.A | ||

Qualifying Expenditure

-

Tax Written Down B/F

0

Additional

17410

Tax Written Down C/F

10446

| Disposal Amount | - |

|---|---|

| Residual Expenditure | - |

| Balancing Charge | - |

| Balancing Allowance | - |

Introduction Video

Share This Page

Share

Tweet

Related Posts

Other Popular Posts