LHDN E-Invoice

讲座overview

马来西亚电子发票 倒数最后一个阶段!也就是最后一个月了!! 如果你到现在还没真正搞懂 E-Invoice,那真的不能再等了!这一次,我们带着 最新 E-Invoice 政策解读 + 实务操作教学, 正式来到你的城市!SQL E-Invoice 全国巡回讲座会强势回归,场场爆满、口碑见证,每一站都不容错过!不只是听讲,而是当场解决你的问题聚焦你最在意、最棘手的实务问题—— 现场提问、现场解答,马上给你可执行的做法,帮你少走冤枉路!别只是“听过”E-Invoice, 而是要真正搞懂、一次做对!

为什么你一定不能错过?

专家亲授:由专业且经验丰富的电子发票讲师主讲,帮你解答最棘手的问题

系统拆解政策更新,一次搞懂 LHDN 最新规则!

真实案例 + 现场 Q&A,你问的问题,这里有最靠谱的解法!

掌握高风险区操作要点,别再用“听说”去赌公司的安危!

一次学习, 帮你把事业中所有关于 E-Invoice 的疑问一次搞清楚。在你的城市,仅此一场 · 免费参加!名额有限,额满即止,立即报名!

Seminar overview

As Malaysia’s E-Invoice implementation reaches its final phase, businesses must act decisively to ensure readiness and compliance. The SQL E-Invoice Nationwide Roadshow provides up-to-date regulatory insights and hands-on implementation guidance, delivered through a well-established program with strong participant feedback nationwide. Designed as a problem-solving session rather than a theoretical seminar, it addresses critical operational challenges and offers immediate, practical solutions through live Q&A—empowering businesses to implement E-Invoice with clarity and confidence. Move beyond simply being aware of E-Invoice— gain clarity, confidence, and implement it correctly from the start.

Why Attend This Session?

Expert-led training by experienced E-Invoice professionals

Structured explanation of the latest LHDN requirements

Real-world case studies and interactive Q&A

Key guidance on high-risk operational areas to ensure compliance and reduce business risk

One session is all it takes to address all E-Invoice-related concerns impacting your business. Free admission · One session only in your city Limited seats available. Registration is required.

SQL Nationwide Conference 2026

💼 专业会计视野

每年都有一系列政策更新?别怕。年度SQL研讨会,又来了。今年,我们来看懂制度,拿捏灰色地带,精准应对 E-Invoice & SST。同时,探讨SQL e-Invoice 的系统掌握,不只是工作的一部分,而是你升职加薪的筹码。

📊 放宽期结束,全面合规时代来临

许多企业即将步入 E-Invoice 放宽期(relaxation period)的尾声,也就是说,

LHDN 将正式进入 全面合规与审计阶段(Ready for LHDN e-Invoice Audit Compliance)。大家准备好了吗!?

这一次的研讨会,我们会:

1️⃣ 和大家看懂 2026 政策与方向

2️⃣掌握SST新增的各行业趋势与新逻辑

3️⃣ E-Invoice Audit 重点要求

4️⃣当 e-Invoice & SST 制度成了枷锁,SQL 为你解锁被规则困住的灵活性

5️⃣ Q&A 环节,尽管问,我们能把问题解决到位。

🧾 课程制订的方向专对:

– Accountant / 会计师

– Auditor / 稽核师

– Bookkeeper / 财务主管

– ERP / E-Invoice 系统实施负责人

📅 立即报名参加《专业会计视野》讲座,掌握最新政策、实务趋势与系统应对方案。这是一年一度,SQL 赞助的年度研讨会。记得踊跃参与哦!

SQL Business Budget 2021

The Budget 2021 is expected to be unveiled on 6 November 2020 with focus on 4 themes:

1. Caring for the People

2. Steering the Economy

3. Sustainable Living

4. Enhancing Public Service Delivery

It is expected to set the SME and rakyat on the right track to post-pandemic economic recovery.

2020 is a love and hate year as businesses faced the biggest challenge in their lives, writing off few years’ profit in a single month. Conversely, it is the first time

businesses successfully claimed a subsidy or grant from government.

Budget 2021 is expected to complement by the recovery packages rolled out, which includes Wage Subsidy Programme and Penjana packages. Question is : is there more to grab?

It is also expected to see heavy emphasis on deployment of technological and digital adoption by SMEs, and nurture digital innovation by young entrepreneurs. Back by tax rebates and digitalisation grants from MDEC, it seems like it will be an interesting year to come.

Let us discover more and how you can position yourself to take advantage of these initiatives.

Not only that, the webinar is also a yearly refresher course to update you on all the changes in taxes.

Join us at this yearly SQL Business Budget Seminar sponsored by SQL Accounting Software. As a software house, we care about your Business Affairs.

See You there !

SQL Hands On E-Invoice Implementation Physical Training

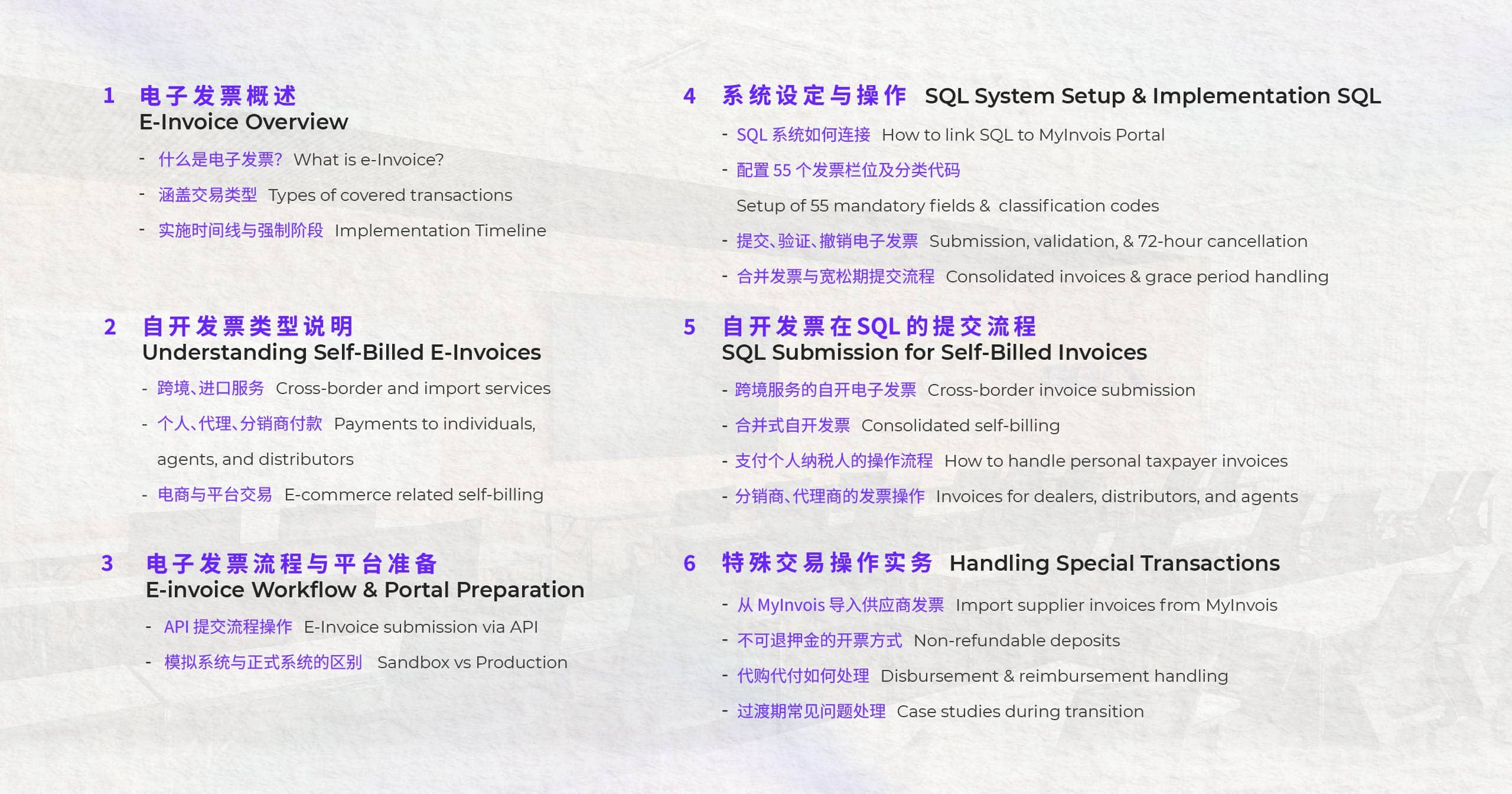

As Malaysia transitions into full e-Invoicing implementation, SQL offers a focused in-person training session to guide participants through the practical setup of their e-Invoice system. Led by experienced SQL Trainers, this session ensures your system is fully prepared for compliant and efficient e-Invoice submission.

This training comprehensively covers the end-to-end setup process from integrating the MyInvois Portal with the SQL system, configuring all 55 mandatory e-Invoice data fields and classification codes, to managing complex transaction scenarios and avoiding compliance risks or penalties. Select your preferred training date below to systematically master the key setup and submission steps for e-Invoicing—ensuring your system is fully prepared for implementation.

.

随着马来西亚电子发票政策全面实施在即,SQL 特别推出线下实操课程,帮助企业以最直接有效的方式完成电子发票系统设定。本课程由经验丰富的 SQL 培训师现场指导,确保学员在课程结束后,能独立完成系统设置并开始提交电子发票。

本课程全面涵盖从 MyInvois Portal 与 SQL 系统的对接设置、电子发票 55 项必填栏位与分类代码的配置,到各类复杂交易的实际操作处理,以及如何避免合规风险与潜在罚款的关键指南。无论您是刚起步,或已接近上线阶段,都能通过本课程快速掌握电子发票实施的每一个关键步骤,确保系统顺利上线、合规无忧。

立即选择下方培训日期,为全面上线做好万全准备。

SQL Training