How to register an E-Invoice in Malaysia?

Starting August 1, 2024, businesses will need to validate all invoices issued to buyers. You can issue e-invoices either directly through the LHDN official MyInvois portal or via API integration with third-party software connected to the MyInvois portal. Regardless of the method you choose, registering on the MyInvois portal is mandatory. Follow the steps below to complete your registration.

How to register LHDN MyInvois Portal for E-Invoice?

LHDN E-Invoice will be rolled out in three phases starting August 1, 2024. Businesses can now register on the MyInvois portal. Follow the steps below carefully to register your company on the MyInvois portal for E-Invoice creation, submission, sending, or API integration.

Steps to Register LHDN MyInvois Portal For E-Invoice

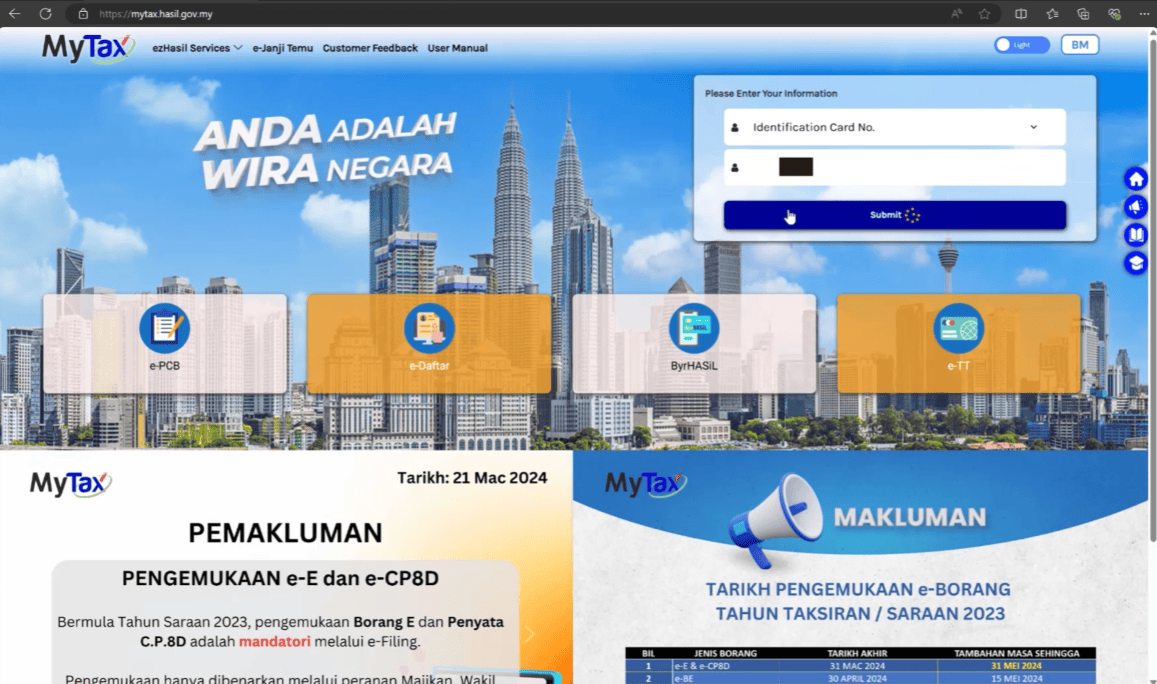

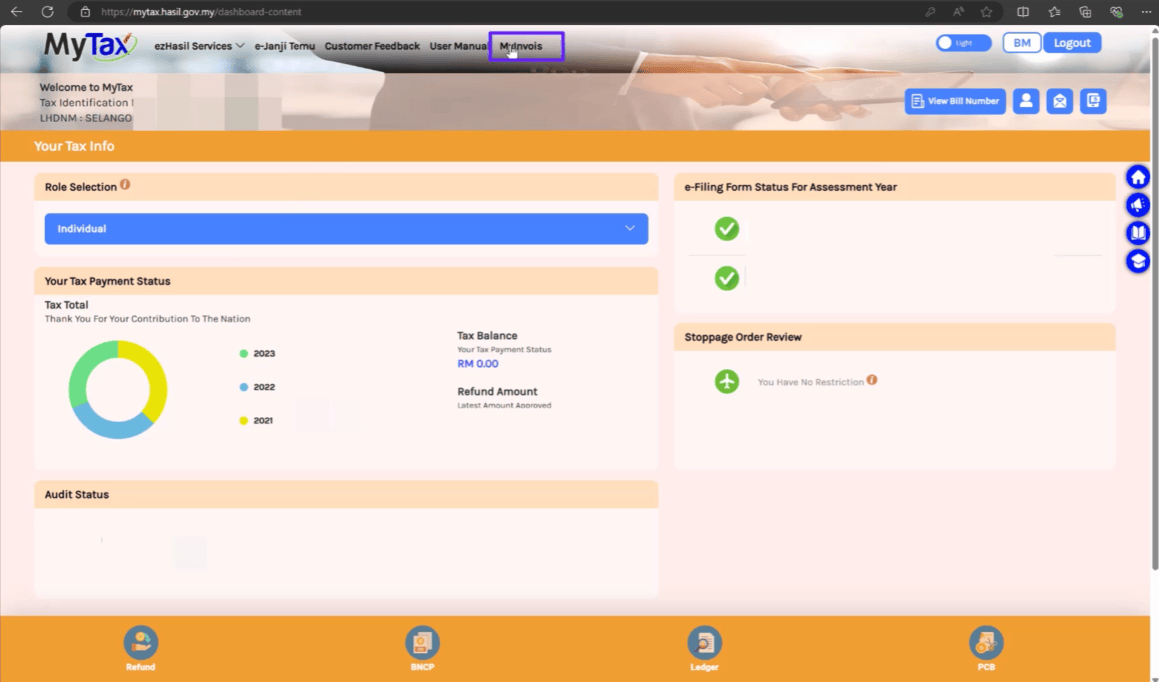

- Visit https://mytax.hasil.gov.my/ and log in using the director’s identification card number. Enter the username and password, then click login.

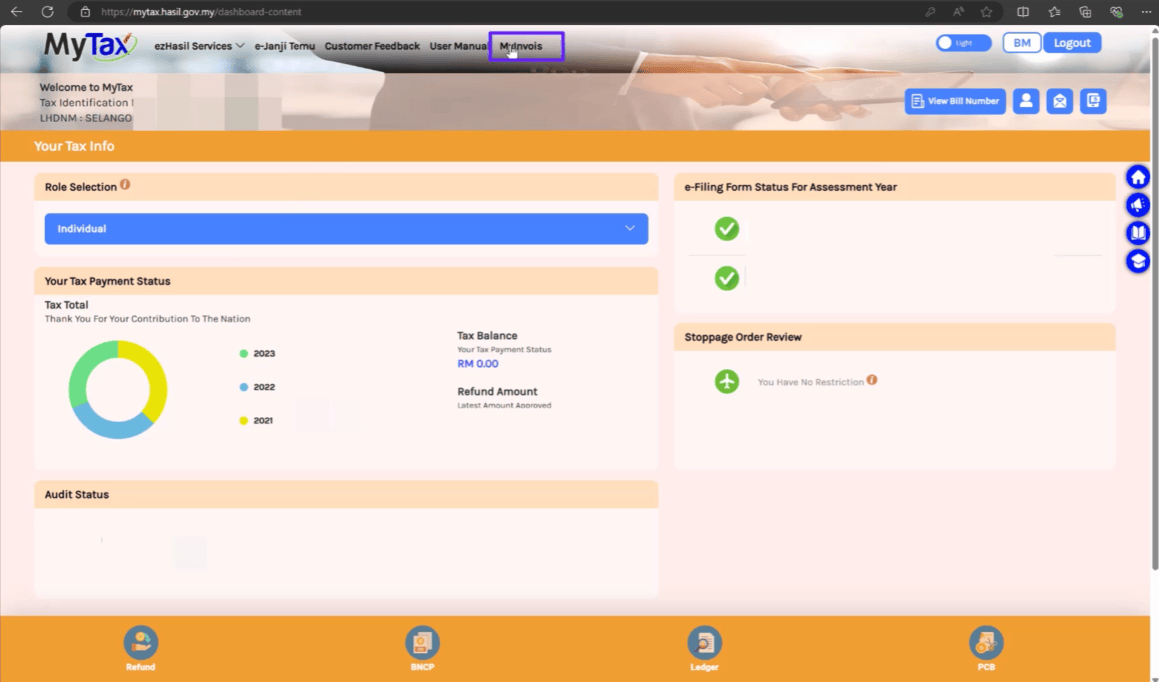

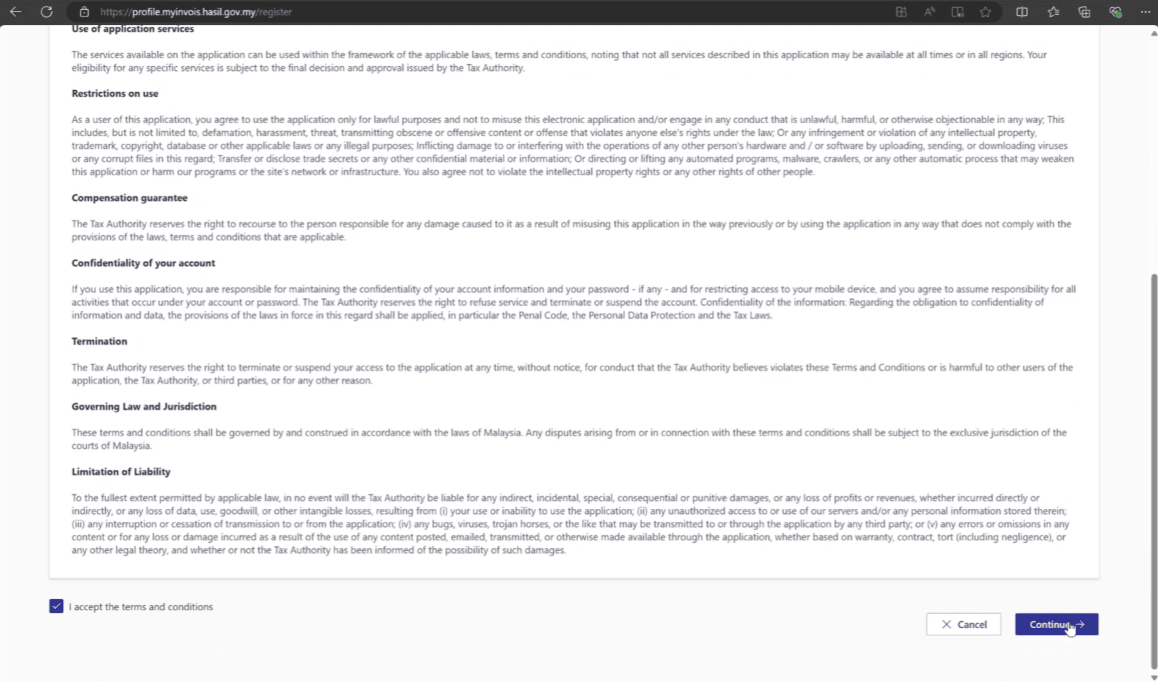

- Select “MyInvois”, read and accept the terms and conditions, and proceed.

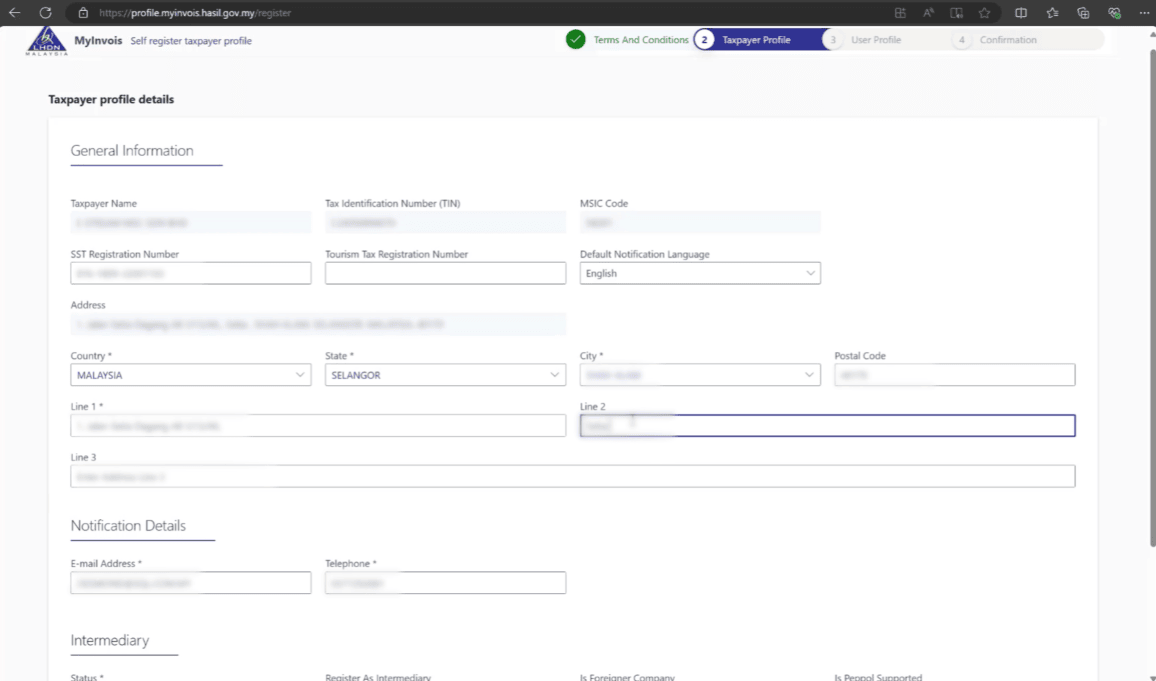

- Enter the SST registration number and tourism tax registration number if available. Ensure that the address, country, state, and postal code are correct, then click save.

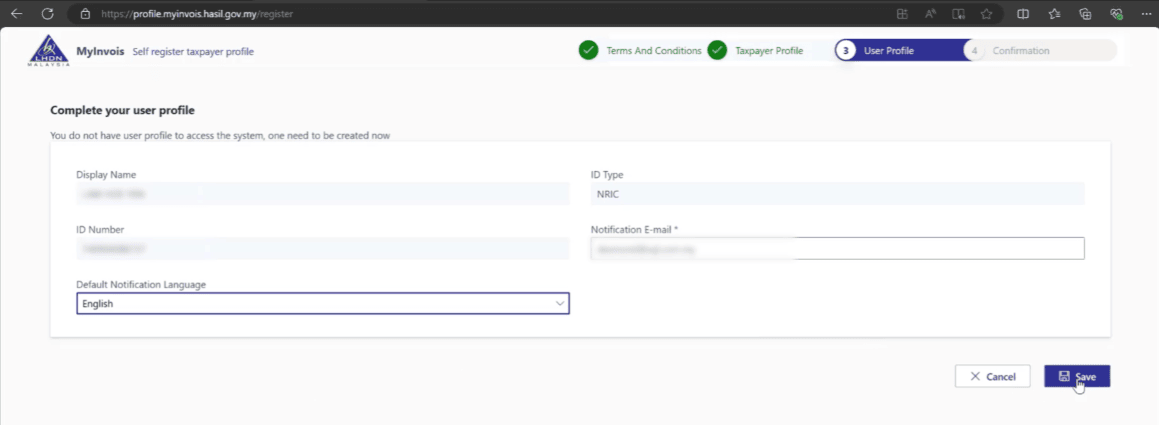

- Enter the notification email, select the preferred language, and save.

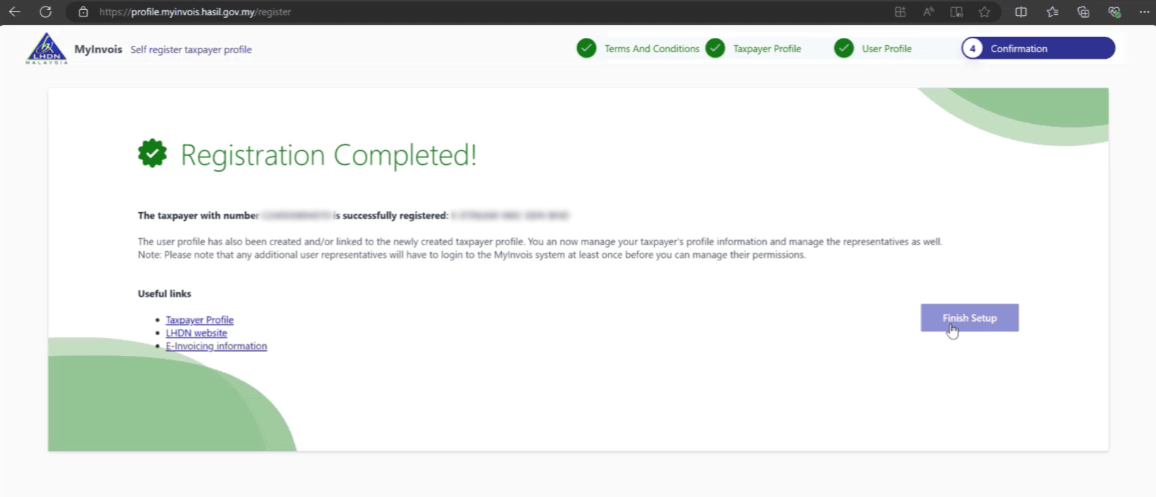

- A registration completion page will appear; click on “Finish Setup”.

registration of LHDN MyInvois Portal Tutorial Video

How to Register an ERP for Accounting Software on the MyInvois Portal?

To authorize any accounting software to connect with the LHDN MyInvois portal for e-invoice purposes, you need to register the software as an ERP. This will allow the accounting software to link to your company’s MyInvois portal. Follow the steps below to complete the registration.

Steps to Register an ERP for Accounting Software on the MyInvois Portal

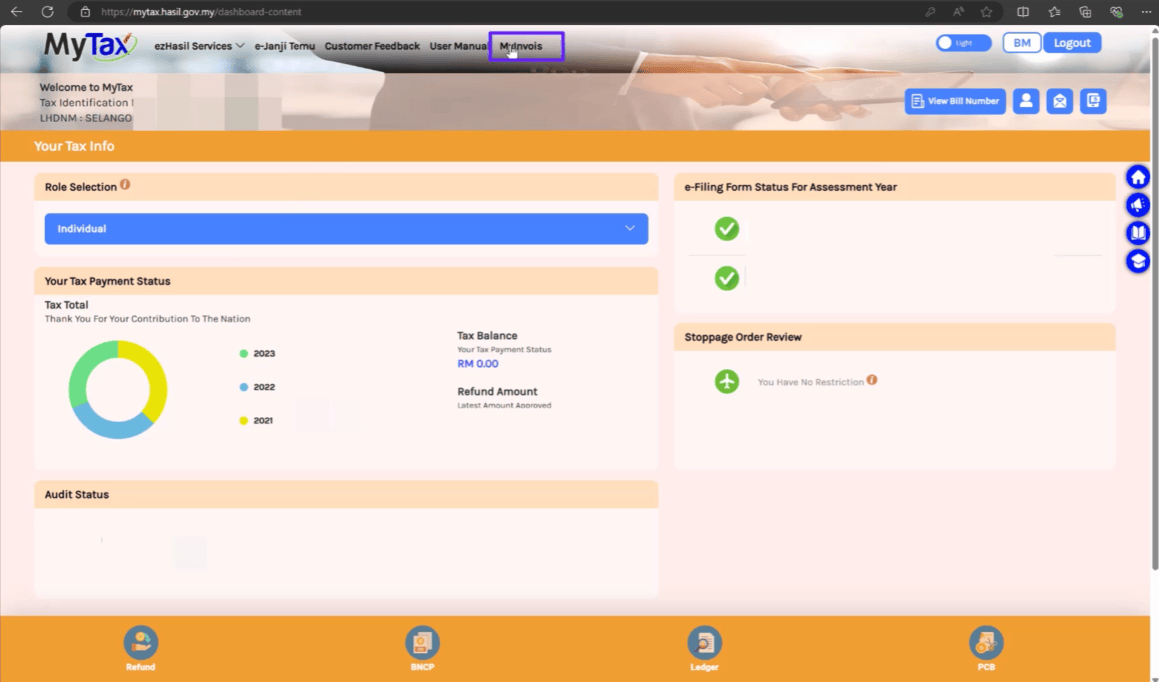

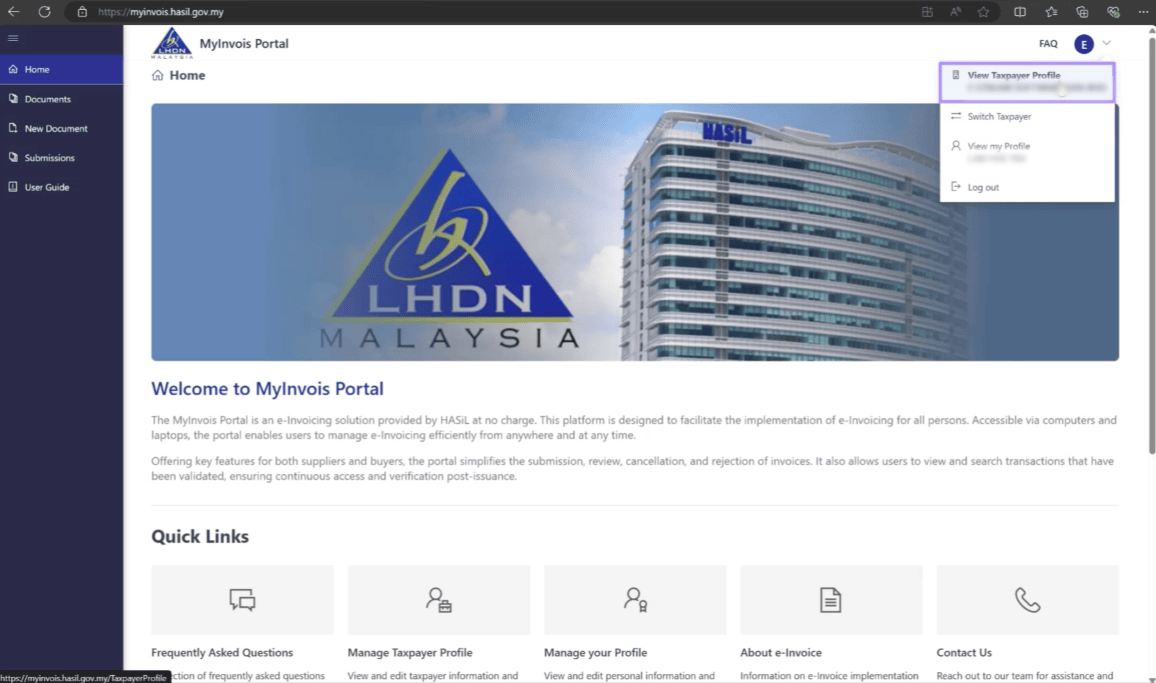

- Visit https://mytax.hasil.gov.my/ , click on MyInvois.

-

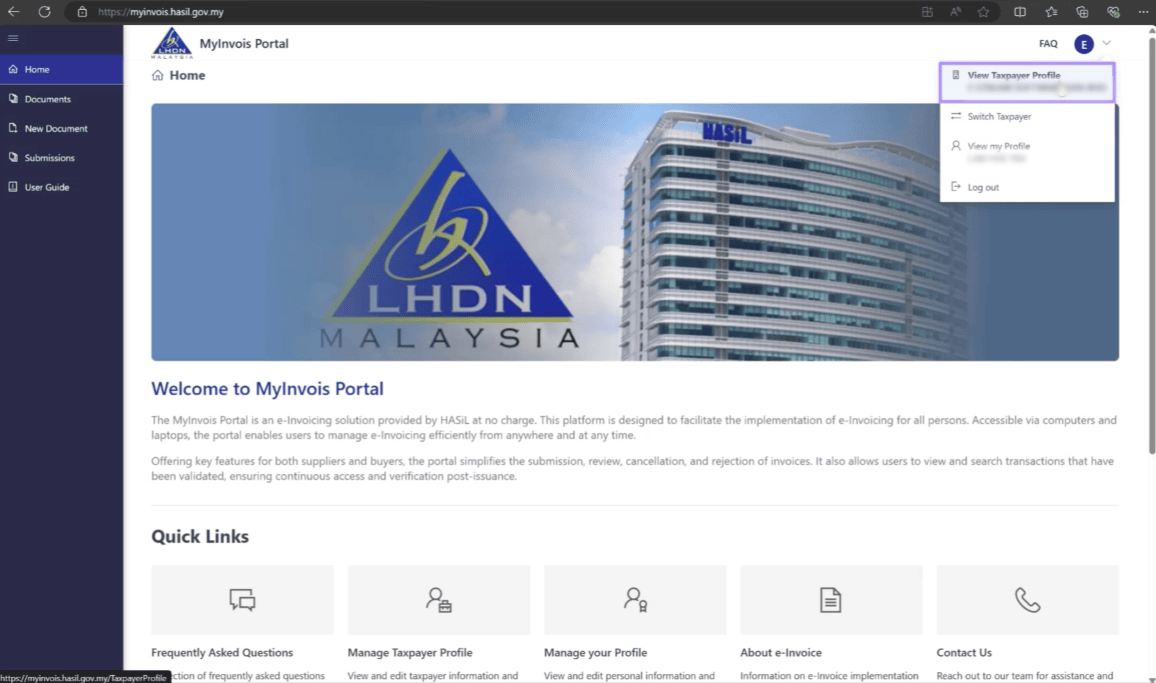

Click on the profile icon at the top right, then select “View Taxpayer Profile“.

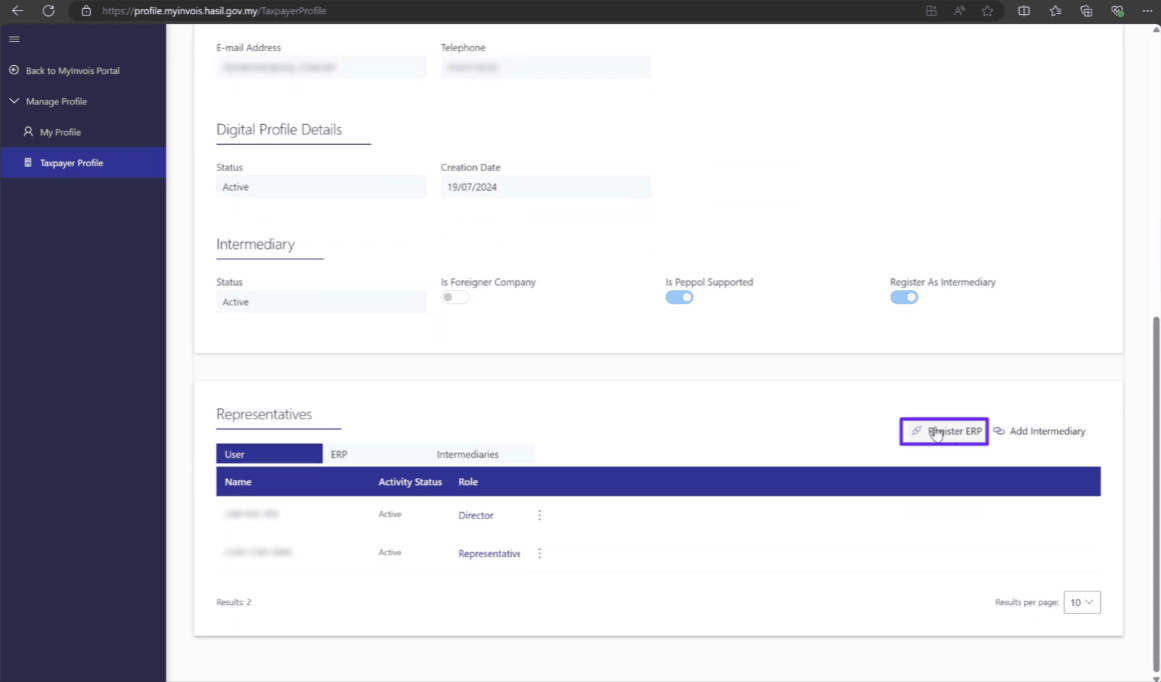

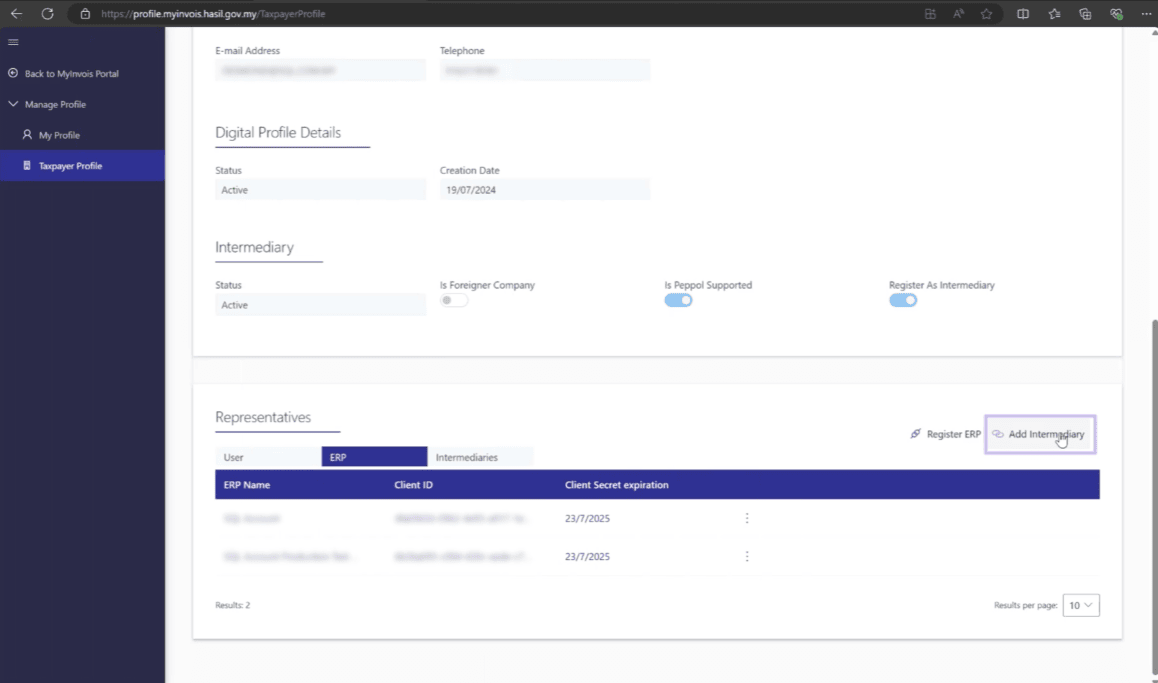

- Scroll down to the “Register ERP” section, click Register ERP.

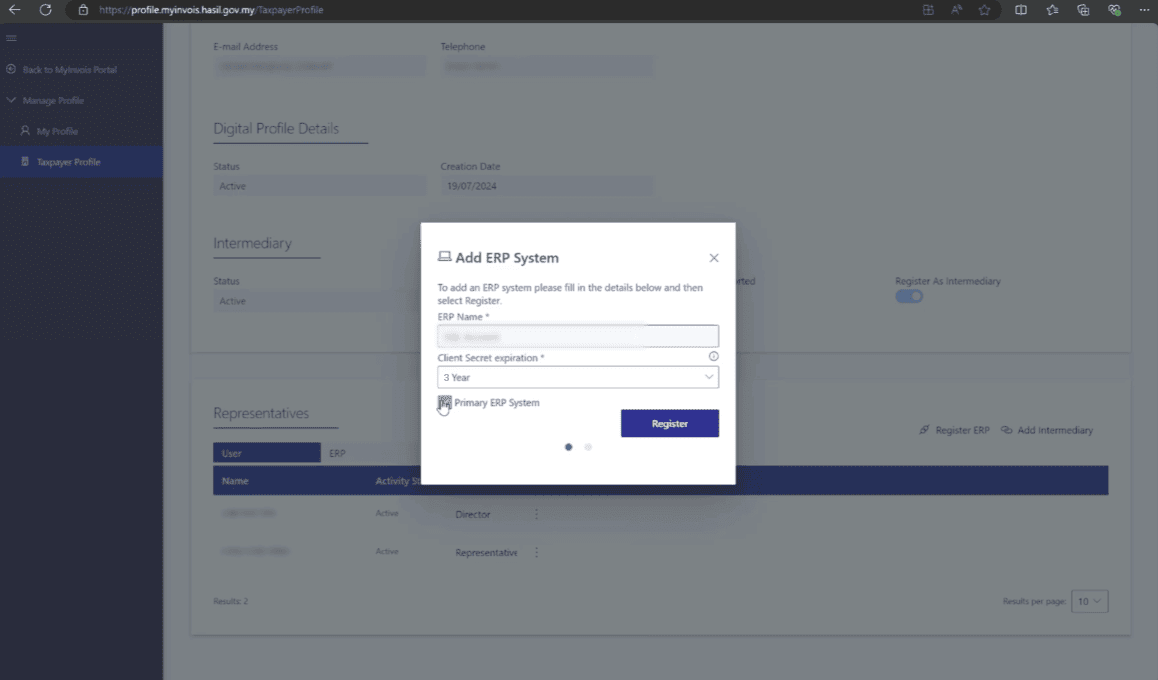

Enter an ERP name, such as “SQL Account ERP,” and select the secret expiration (three years is recommended). Set it as the primary ERP system and complete the registration.

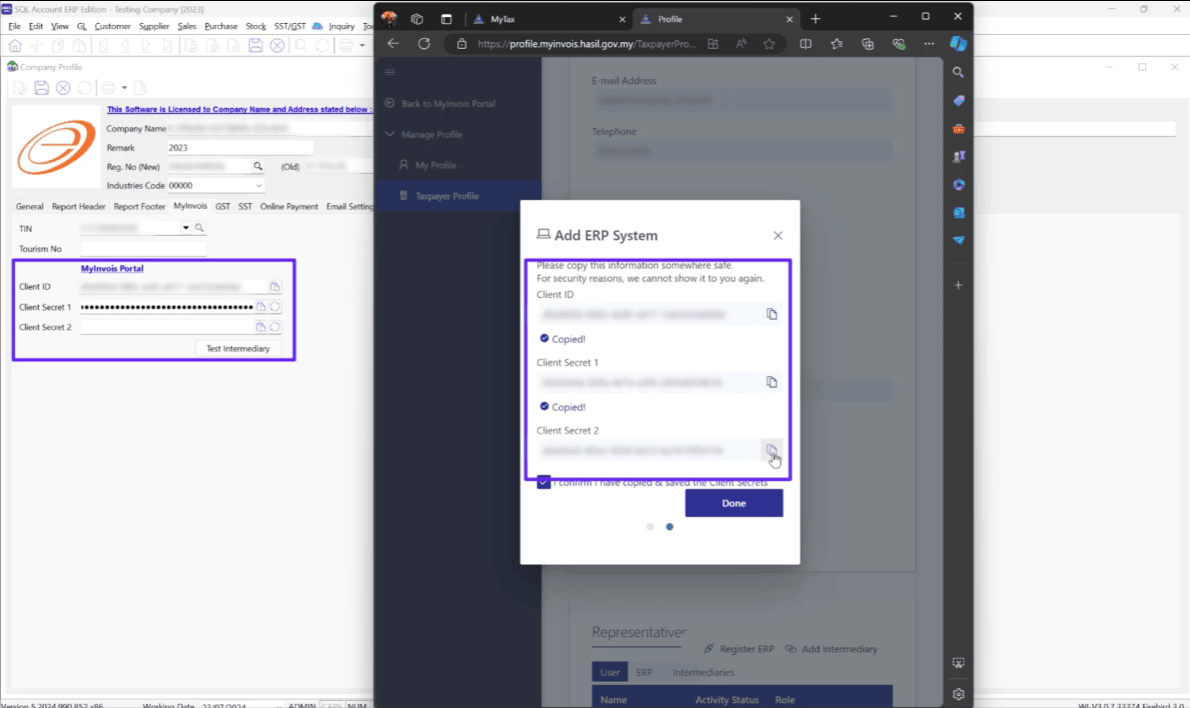

- Copy the Client ID, Secret 1, and Secret 2 one by one and paste them into SQL under File | Company Profile.

How to add an Intermediary for LHDN E-Invoice?

LHDN provides two options for businesses to issue e-invoices: through the MyInvois portal manually or via API Integration. If you choose the API Integration option, you will need to obtain the software company’s information, including TIN, BRN, and Name, to add as an intermediary in the LHDN MyInvois portal. Follow the steps below to add an intermediary.

Steps to add an Intermediary for LHDN E-Invoice

- Visit https://mytax.hasil.gov.my/ , click on MyInvois.

-

Click on the profile icon at the top right, then select “View Taxpayer Profile“.

- Scroll down to the “Add Intermediary” section, click Add Intermediary.

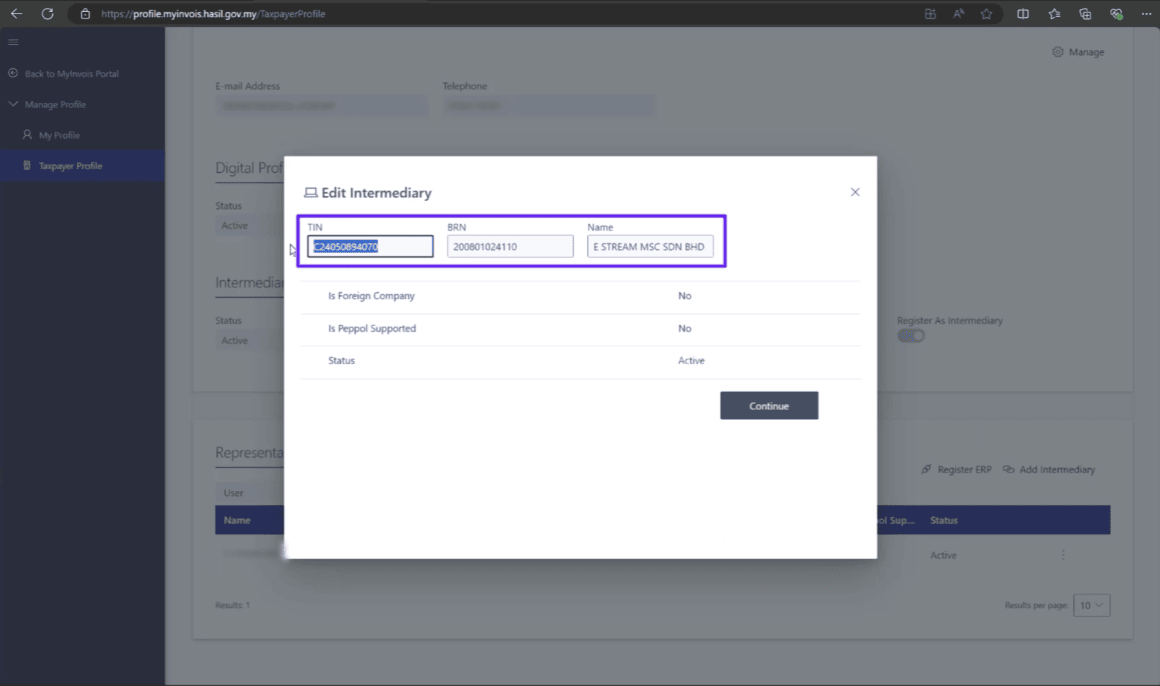

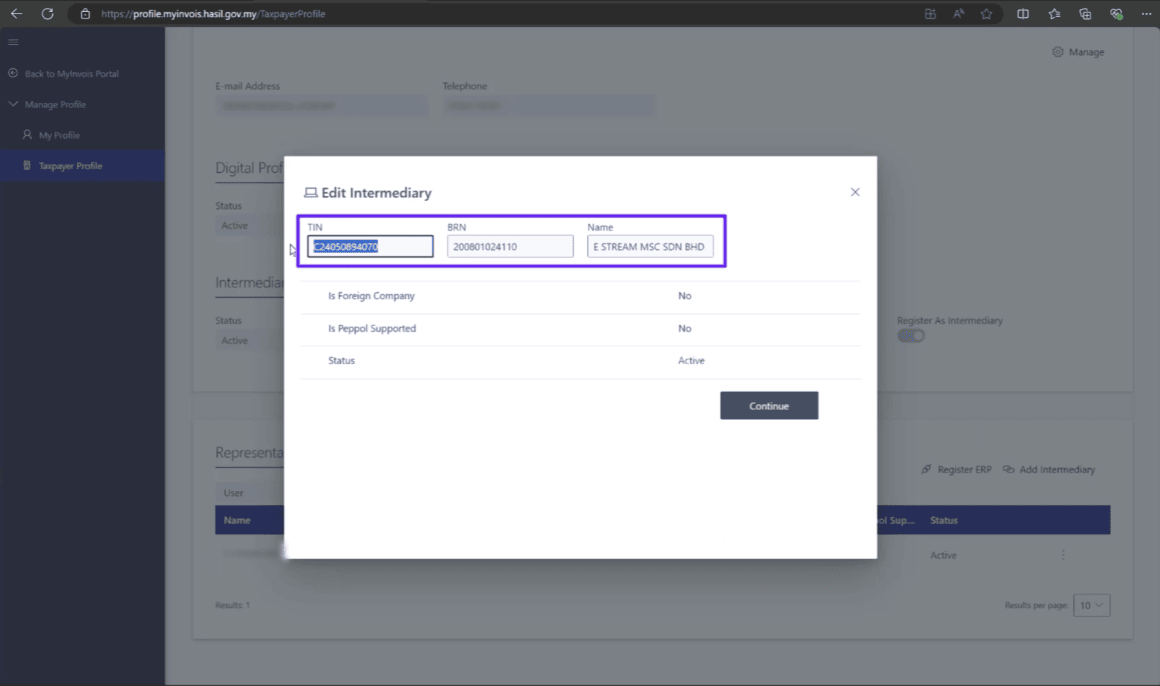

For SQL Account customers, below is the intermediary information for SQL: TIN: C24050894070 BRN: 200801024110 Name: E STREAM MSC SDN BHD Enter software provider TIN, BRN, Name. Click on continue.

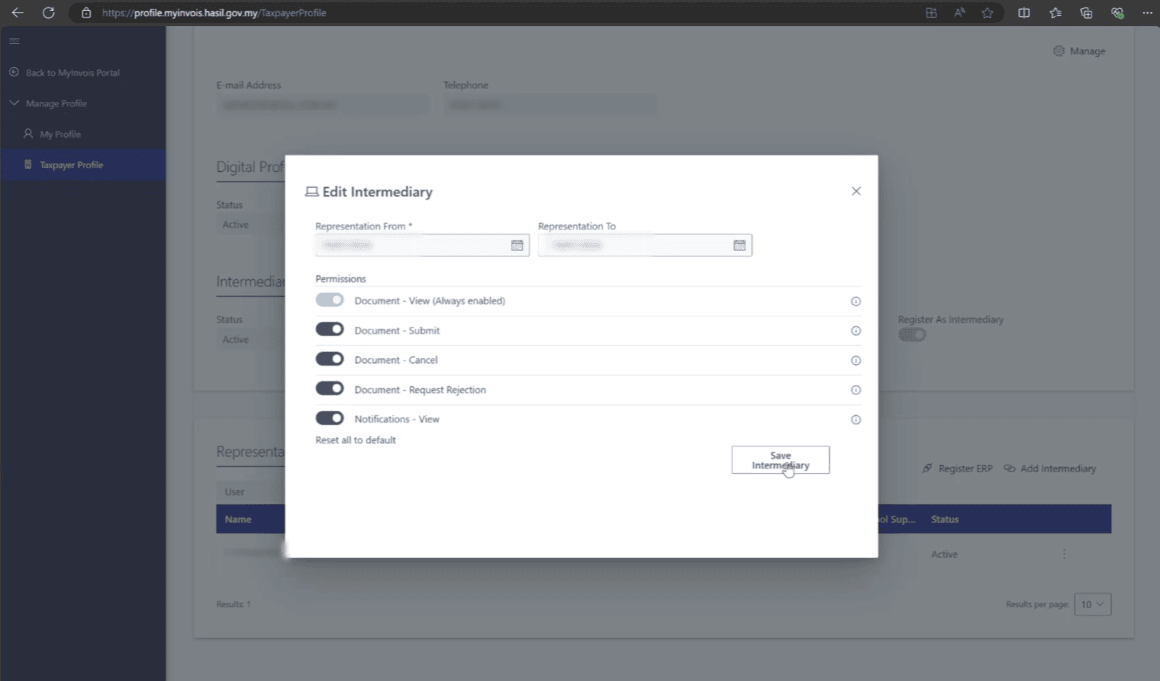

- Insert the representation expiration (three years is recommended).

- Leave the presentation date blank. Ensure all permissions are enabled for e-invoice submission, cancellation, request rejection, and viewing. Save the intermediary.

SQL Accounting Software Favoured Features

SQL Account is an accounting software that is suitable for all businesses, from small businesses to large organizations. It is crucial to find a business solution that suits you. We cater for every industry. Small business, cloud accounting software, to on-premise accounting software, choose the best fit for your business. SQL Account is user friendly & can be integrated with no fuss.

Free Download Accounting Software trial to experience our accounting software.

Access Anytime, Anywhere

Batch Emails Statements

Special Industries Version

Real-Time CTOS Company Overview Reports

Advance Security Locks