From CP22 VS CP22A

What is form CP22?

Form CP22 is a government report that is issued by the LHDN. CP22 is a Notification of New Employee form. An employer must notify the nearest IRB branch within one month on the new employee’s commencement date. If employer fails to do so, they can be prosecuted and liable to a fine of RM 200.00 minimum but not more than RM2,000 or imprisonment for a maximum of 6 months.

With SQL Payroll Software,

you can generate CP22 for your employee’s and other government forms in just one click.

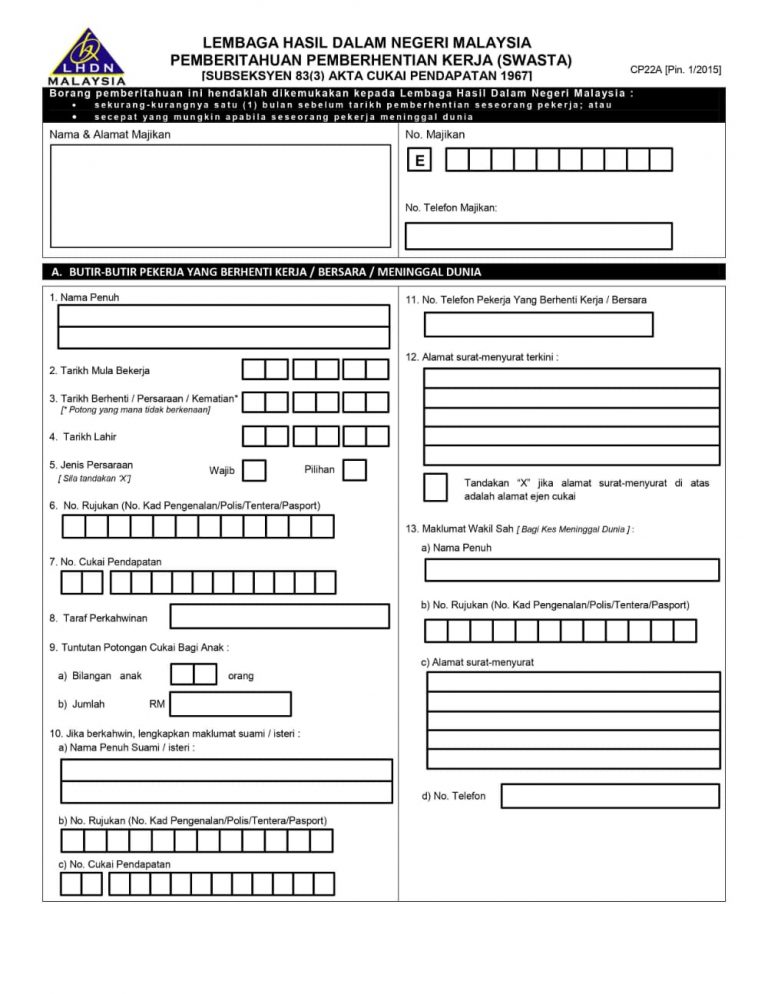

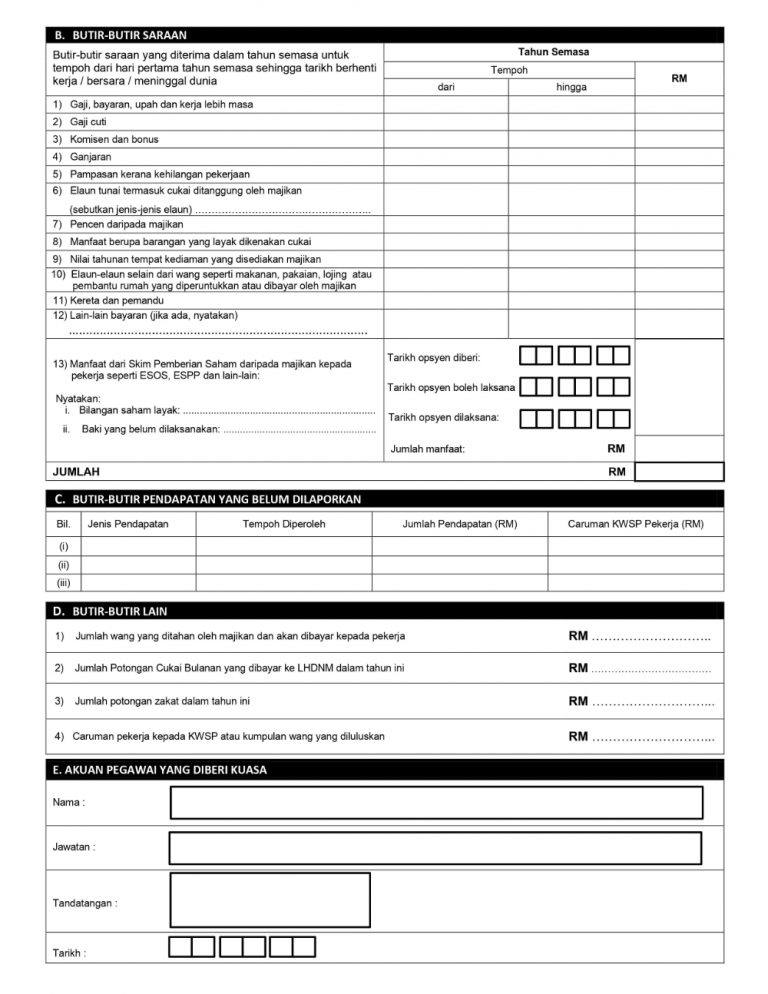

What is form CP22A?

In contrast of the form CP22, CP22A is a cease of employment form. Employer is responsible of notifying IRBM that their employee is about to retire, leave Malaysia permanently or employee is subjected to MTD scheme and the employer has not made any deduction. Employers are given 30 days before the employee’s date of cease of employment to notify IRBM. The employer must withhold money payable to the employee until they receive a Clearance Letter from the Assessment Branch. With SQL Payroll Software, you can generate CP22A for your employee’s and other government forms in just one click.

With SQL Payroll Software,

you can generate CP22A for your employee’s and other government forms in just one click.

Accountant, when come to Borang B & Borang B submission, a common question may ask from your customers:

I just want tax payable RM 8000 only, how much yearly income do I need to report to LHDN? What us my tax bracket %?

SQL Payroll software Favoured Features

Certified by Statutory bodies & 100% accurate

electronic submission & e-Payment ready

Batch email payslip

Comprehensive management reports

Unlimited year records