SQL Delivers The Smartest Way to Manage Malaysia's 55 Mandatory E-Invoice Fields.

Malaysia is entering a new digital tax era led by the Lembaga Hasil Dalam Negeri (LHDN). With the introduction of the e-invoicing system and the requirement to complete 55 specific data fields, businesses must now ensure full accuracy and compliance in every transaction they submit through the LHDN’s MyInvois Portal.

While the system is designed to create transparency and efficiency, many companies find it complicated to manage every field manually. This is where SQL Accounting Software delivers a smart, automated solution that makes compliance effortless and efficient.

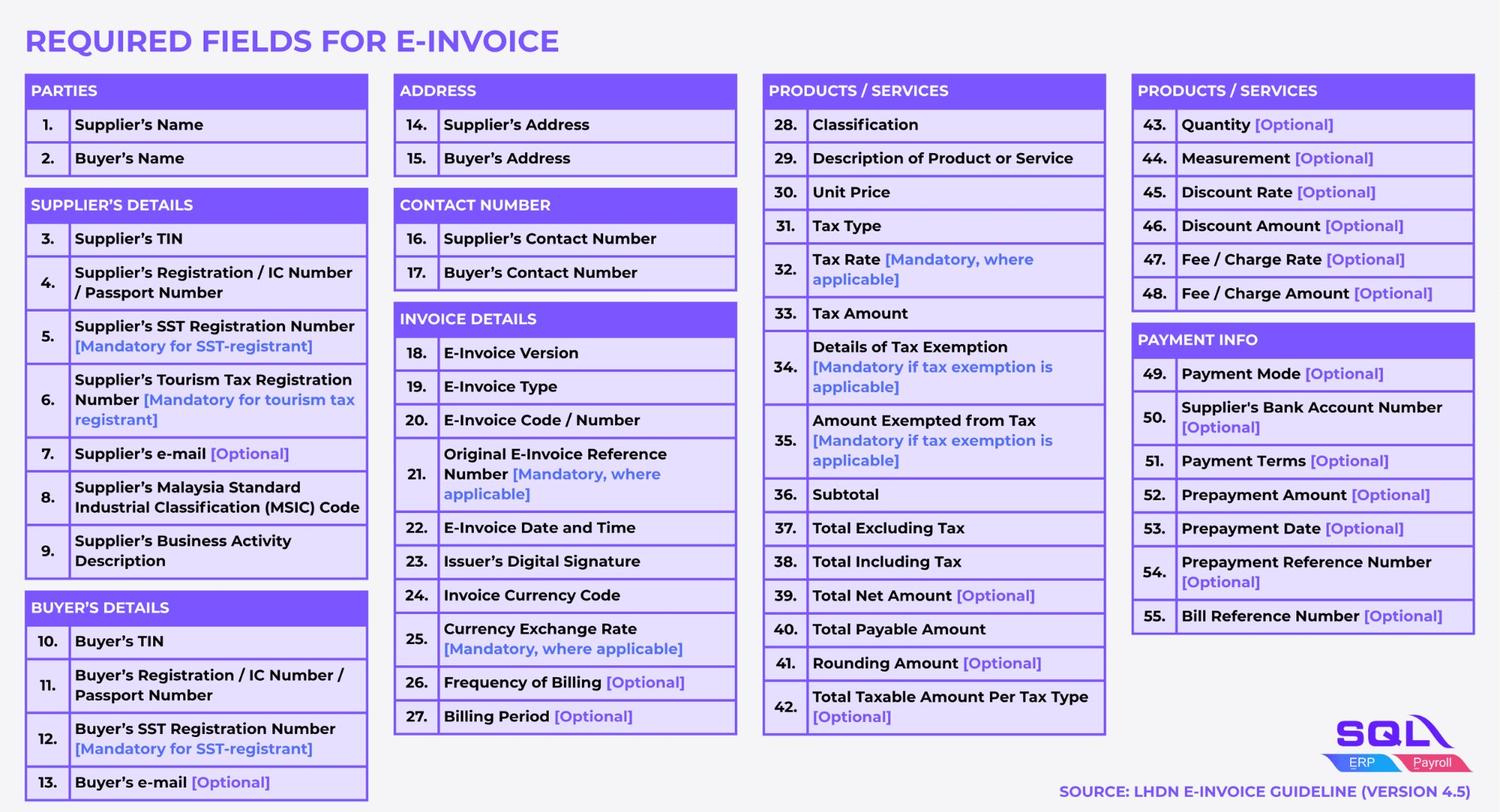

Understanding Malaysia’s 55 Specific E-invoice Fields

An e-invoice is a verified digital document that records a transaction between a supplier and a buyer. To comply with LHDN’s structure, each e-invoice must include 55 specific fields, consisting of 35 mandatory and 20 optional fields that cover seller and buyer details, contact information, invoice data, product or service details, and payment information. SQL Account streamlines this process by automatically storing and managing all field data, eliminating the need for repetitive manual input.

Each field contributes to the completeness of a transaction record, allowing for digital validation, tracking, and auditing by the LHDN at any time. These fields are designed to ensure that every invoice submitted complies with Malaysian tax regulations under the Income Tax Act of 1967, Sales Tax Act of 2018, and Service Tax Act of 2018.

Below is the complete breakdown of all 55 required e-invoice fields, as outlined in the LHDN Official E-Invoice Guideline (Version 4.5)

For a more detailed explanation of each field setup guidance, visit SQL Guide: 55 Data Required for E-Invoicing

Why Managing These Fields Manually is Challenging

Completing 55 fields for every transaction can be time-consuming, especially for SMEs that issue hundreds of invoices per month. Without a system to automate validation, errors like missing TINs or incorrect tax calculations can cause rejections by LHDN’s MyInvois system.

Manual data entry also increases the likelihood of inconsistencies between invoice records and accounting ledgers. These mismatches can disrupt financial reporting and slow down cash flow when clients or suppliers dispute inaccurate invoices.

As Malaysia transitions to full e-invoicing by 2026, businesses that continue using manual methods risk delays and compliance penalties.

SQL Accounting: The Smarter Way to Manage All 55 Fields

SQL Accounting simplifies every aspect of e-invoice management by automatically linking your accounting data to LHDN’s e-invoice format. Once you create an invoice in SQL, the system automatically maps the information into all 55 required fields.

It performs real-time validation to ensure completeness and accuracy before submission, significantly reduces rejection risks. SQL also integrates directly with the MyInvois portal through API connectivity, allowing seamless submission and tracking without leaving the system.

SQL’s built-in templates ensure that all mandatory information is filled correctly while maintaining your preferred invoice design. When LHDN updates or revises field requirements, SQL’s automatic software updates ensure your business always remains compliant.

The Benefits of Automating E-Invoice Compliance with SQL

Businesses using SQL Accounting enjoy several key advantages. Automation dramatically reduces the time spent preparing and checking invoices. Integrated validation rules ensure that every field meets LHDN’s latest data structure, eliminating submission rejections.

Moreover, all validated e-invoices are securely stored within SQL’s database, giving businesses instant access to past records for audits or reconciliations. The system also supports both cloud and desktop versions, providing flexibility to adapt to your business environment.

The combination of auto-mapping, batch processing, and audit-ready reporting turns SQL into the most efficient solution for Malaysia’s e-invoice transition.

Future-Proof Your Business for Malaysia's E-invoice Era

The LHDN e-invoice framework is being implemented in stages according to business turnover thresholds. By 2026, nearly all registered entities will be required to issue e-invoices for every transaction.

SQL Accounting continuously evolves with LHDN’s updates, meaning users can confidently manage compliance through every phase of rollout. Whether you operate a micro-business or a large corporation, SQL ensures that your e-invoicing process stays seamless, accurate, and ready for the future.

Simplify Your E-Invoice Compliance Today with SQL

The transition to e-invoicing is one of Malaysia’s most important steps toward a digital economy. Managing these 55 fields manually can be overwhelming, but SQL Accounting makes the process effortless.

With automated data mapping, real-time validation, and full integration with LHDN’s MyInvois, SQL delivers the smartest way to manage Malaysia’s e-invoice requirements. Businesses that adopt SQL today are not only compliant but also equipped for long-term digital success. Learn more about how SQL can simplify your e-invoicing journey at SQL E-Invoice.